Buy or Lease a Car?

March 10 2025,

This question is often asked, and each time we consider the needs of our clients. After all, each individual will be behind the wheel of their vehicle.

In other words, if you are shopping for a vehicle, you've probably wondered whether it is better to lease or buy a car. In fact, both options are good, but depending on certain criteria, one may be more beneficial for you.

Cadillac Laval tells you more about the pros and cons of each of these two financing methods; you will see if, for you, it is necessary to buy or lease an electric or gasoline car! And you can count on your Cadillac dealer for both purchasing and leasing a car in Laval.

Should you Buy or Lease a Car?

Criteria to Consider

To start with, buying a vehicle will be more expensive than leasing a car. Indeed, buying outright involves a significant cash outflow compared to leasing.

Moreover, if you intend to change vehicles more often, leasing a car will be more economical, and you will have the opportunity to drive a new vehicle more frequently.

Finally, it's important to know that the maintenance of a leased vehicle is often less expensive than a new vehicle that you will keep for a longer period.

In short, there are criteria to consider when it comes time to lease or buy. Your Cadillac dealership allows you to lease a car in Laval that will meet your needs.

Pros and Cons of Buying and Leasing

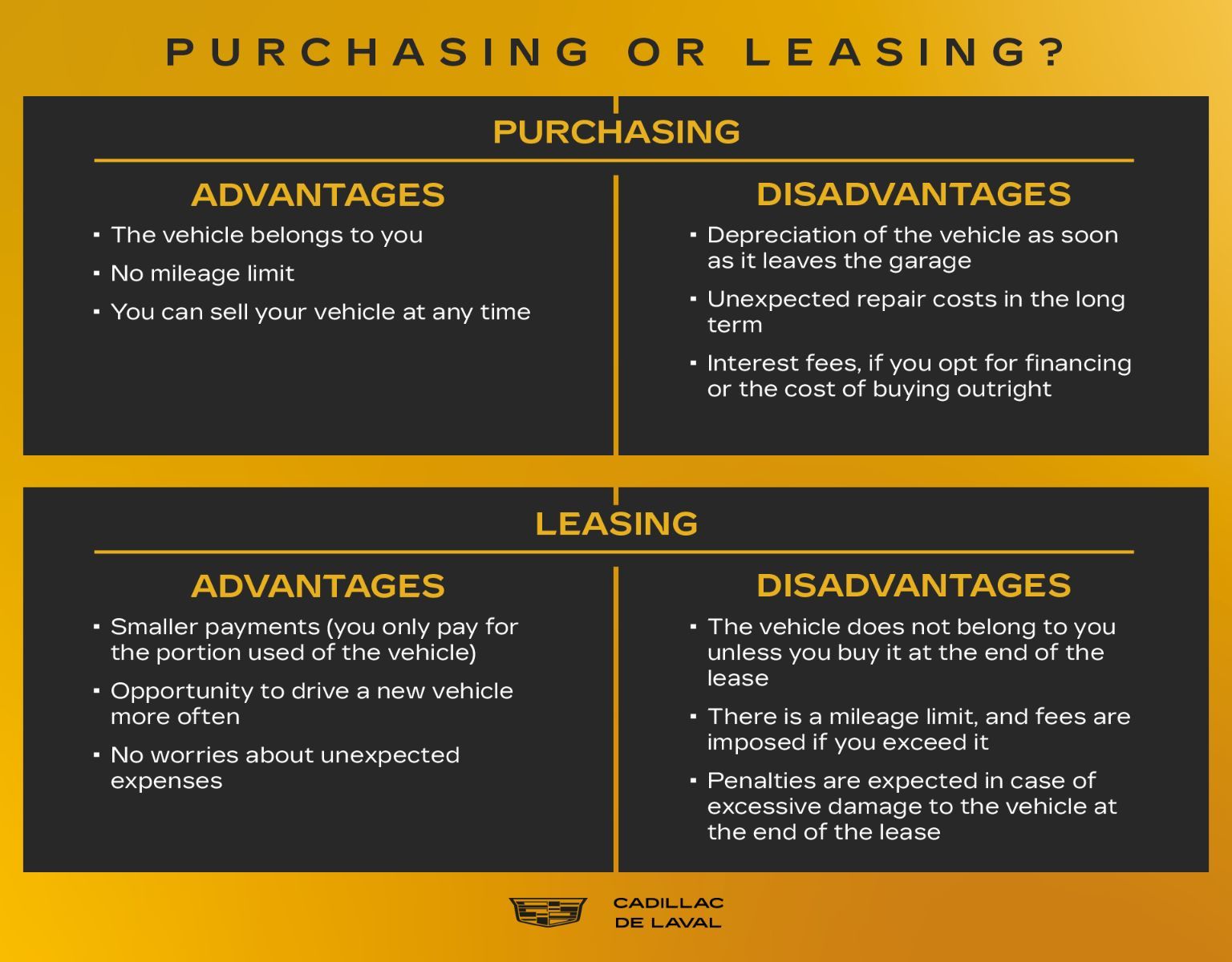

To better illustrate leasing a car vs. buying a car, we have highlighted the advantages and disadvantages of each.

Firstly, the benefits of buying a vehicle are numerous; however, there are some drawbacks to note:

From the above, buying a vehicle certainly has advantages, but also disadvantages. The two questions to ask are: what use will you make of your vehicle? Is it worth absolutely buying it?

As you can see, buying or leasing a car has as many advantages as disadvantages. Thus, a driver traveling 50,000 kilometers annually will be disadvantaged by leasing but will appreciate that there is no mileage limit when buying the vehicle.

Similarly, a buyer who doesn't travel much has every interest in leasing their vehicle to benefit from lower monthly payments. They can change their vehicle more often and lease a new Cadillac of the year. We will assist you with car leasing in Laval.

What about Buying vs. Leasing Electric Cars?

Again, it depends on your needs! If the current model you want to purchase has sufficient range and charging time for you and you don't think your needs will increase in the next 4 or 5 years, buying is a good option for you.

Conversely, if you need to recharge often on the way, the range is limited for you, and the charging times seem a bit long - but you still want to drive an electric vehicle now - leasing an electric car will be the most judicious option.

Why? Simply because technologies are progressing rapidly in vehicle electrification, and power and range are increasing, while charging times are decreasing.

How does Buying a Car Work Compared to Leasing?

There are different ways to buy a vehicle:

- Buy by paying cash;

- Opt for financing, with or without a down payment.

Obviously, by taking out a loan with your financial institution or the dealership, you will have interest to pay, but you can choose your term (48, 60, or 72 months).

By paying cash, you will have no interest, of course.

On the other hand, leasing a car involves signing a contract just like buying. Here too, you will have the choice between different terms, shorter or longer, depending on your lease agreement. The lease contract will bind you for the entire duration of your lease, but know that your monthly payments will be reduced compared to purchasing via financing through your financial institution.

Lease and Purchase Options Available at Cadillac Laval

Long-Term Lease 24 Months

At your dealership in Laval, you will have the opportunity to lease your Cadillac for the lowest price for a set period. Long-term car leasing in Quebec is also possible at your dealership.

For example, it will be possible to lease a Cadillac Escalade or a Cadillac Lyriq over an extended period.

While we are talking about a 24-month lease here, know that a 36-month lease for your car is possible or even more.

Financing for Buying your Car

Are you ready to get financing for your vehicle? You can take out an auto loan directly with your financial institution by making an appointment with an advisor.

But the most common method is to do business with the dealership where you will buy your vehicle; a financing specialist will then make arrangements with one or more financial institutions to obtain the most advantageous repayment terms for you.

Take advantage of the benefits and flexibility of Cadillac financing. An experienced team takes care of everything.

Why Choose Cadillac Laval for your Leasing or Purchase?

At Cadillac Laval, you will experience an extraordinary customer experience. We take the time to answer all your questions, and our Cadillac offers and promotions are constantly striving to adapt to the various budgets of our clientele.

Come discover the full range of vehicles for purchase or lease at the dealership in Laval, near Montreal, West Island, North Shore of Montreal, and Blainville. A talented team awaits you.

FAQ

How to End a Car Lease?

It is possible to terminate a lease agreement. You can, for example, transfer your lease to a third party, buy the vehicle, or change your rental car. Consult an advisor for all the details.

Why Buy a Car in Cash?

If you can afford to pay the price of a new vehicle in cash, go for it! This way, you will save on interest charges, which can increase the cost of the vehicle.

Why Lease a Car?

If your budget is limited but you want a new car, leasing can be an excellent option. Plus, you'll be able to change vehicles more often!

Can you Lease a Used Car?

Some dealerships offer this option, allowing you to save a little more on monthly payments; inquire with the dealership.

Can you Sublease a Rental Car?

It is entirely possible to transfer your lease to another person with the dealer's agreement. This way, you will save thousands of dollars in contract termination fees. However, you will not be able to sublease your car for a long-term lease.

How Much does it Cost to Lease your Car Long-Term?

It all depends on the type of vehicle to start! Indeed, an entry-level sedan will cost much less in lease than a high-end SUV like the Escalade. Similarly, long-term vehicle leasing will allow you, at the end of the lease, to repurchase it for a lower amount than if you had opted for a 36 or 48-month lease, for example.

How to Calculate the Cost of a Leased Car?

To know the cost of a rental car, you will need to consider the following aspects:

- The base monthly payment

- The accessories you have added

- The extended warranty (if applicable)

- The duration of the lease contract (which varies the monthly payments)